Effortlessly submit an import declaration in

3 minutes with our award-winning software

We help you streamline trade with AI

Customs declaration service (CDS) is an electronic system for submitting the declarations to the HMRC. CDS softwares uses AI for managing trade activities on a single forum.

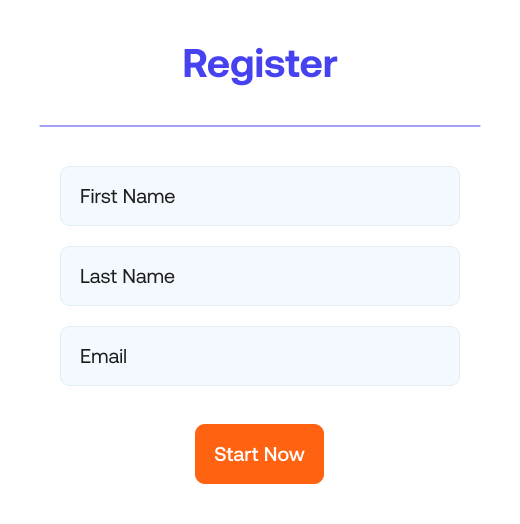

All importers must register to UK customs declarations. You have to register to CDS from HMRC Government gateway to get VAT, duty adjustments and get postponed import VAT statements.

The goods that aren’t included are:

For UK CDS customs importing, the goods that require special permits are:

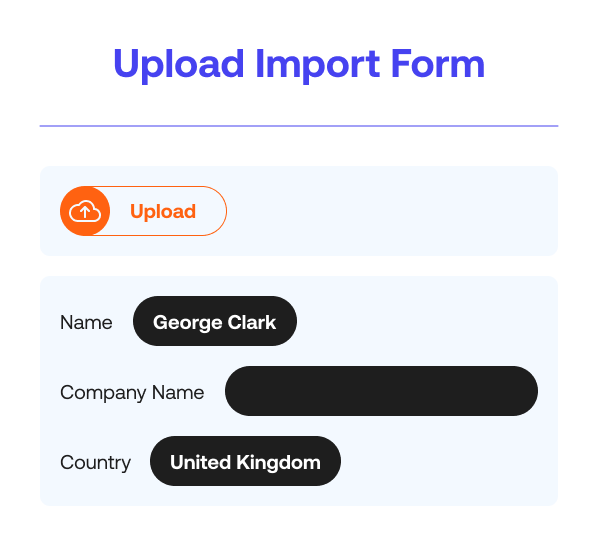

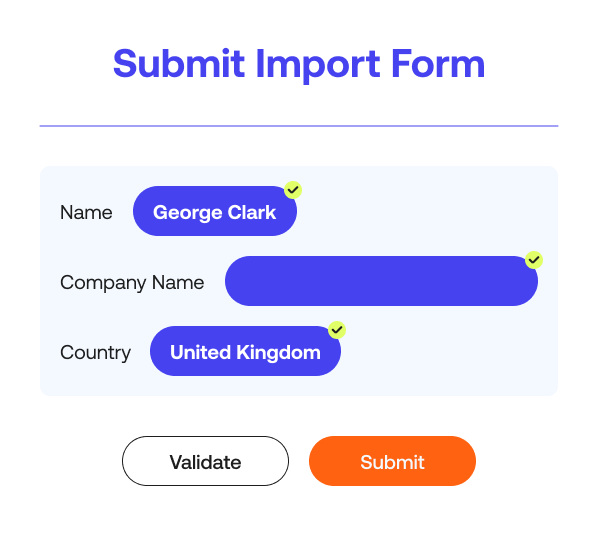

HMRC has given permit to using import CDS software that’s verified with HMRC. The software is beneficial in multiple import declarations with smart automation.

They need the following:

AI solutions for all your customs clearance processes